Choose your style of Timber Sound acoustic plank

Timber Sound is now available through SoundPly!

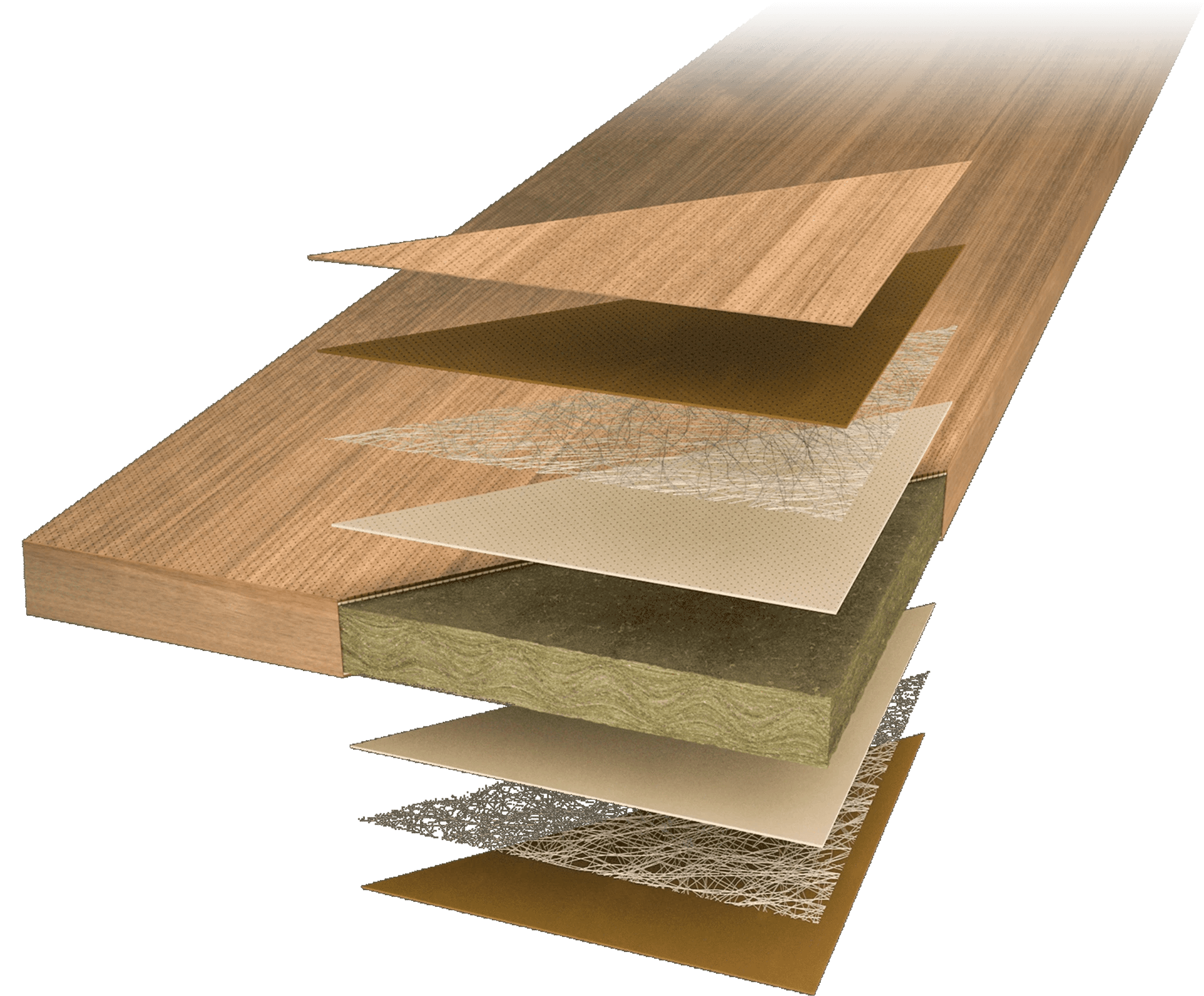

Timber Sound Wood Planks

Beautiful & unique

acoustic control

It’s beautiful! It only adds to a room.

– Stacy P